Learn about University of California including our News & Press Releases, Featured Projects, and Finance Team.

Talk to us

Have questions? Reach out to us directly.

Learn about University of California including our News & Press Releases, Featured Projects, and Finance Team.

About University of California

- General Revenue Bond Rating

- Aa2/AA/AA

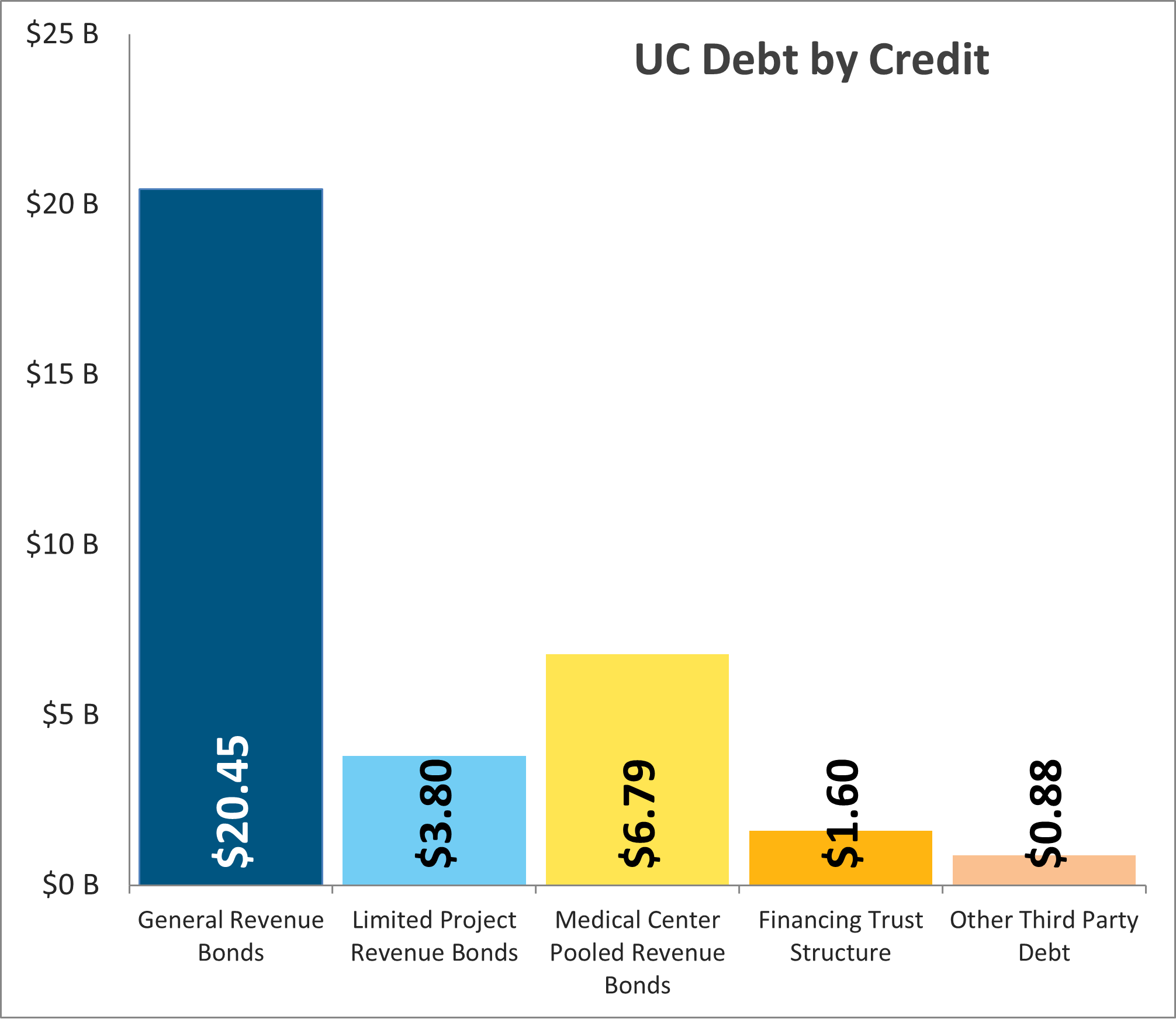

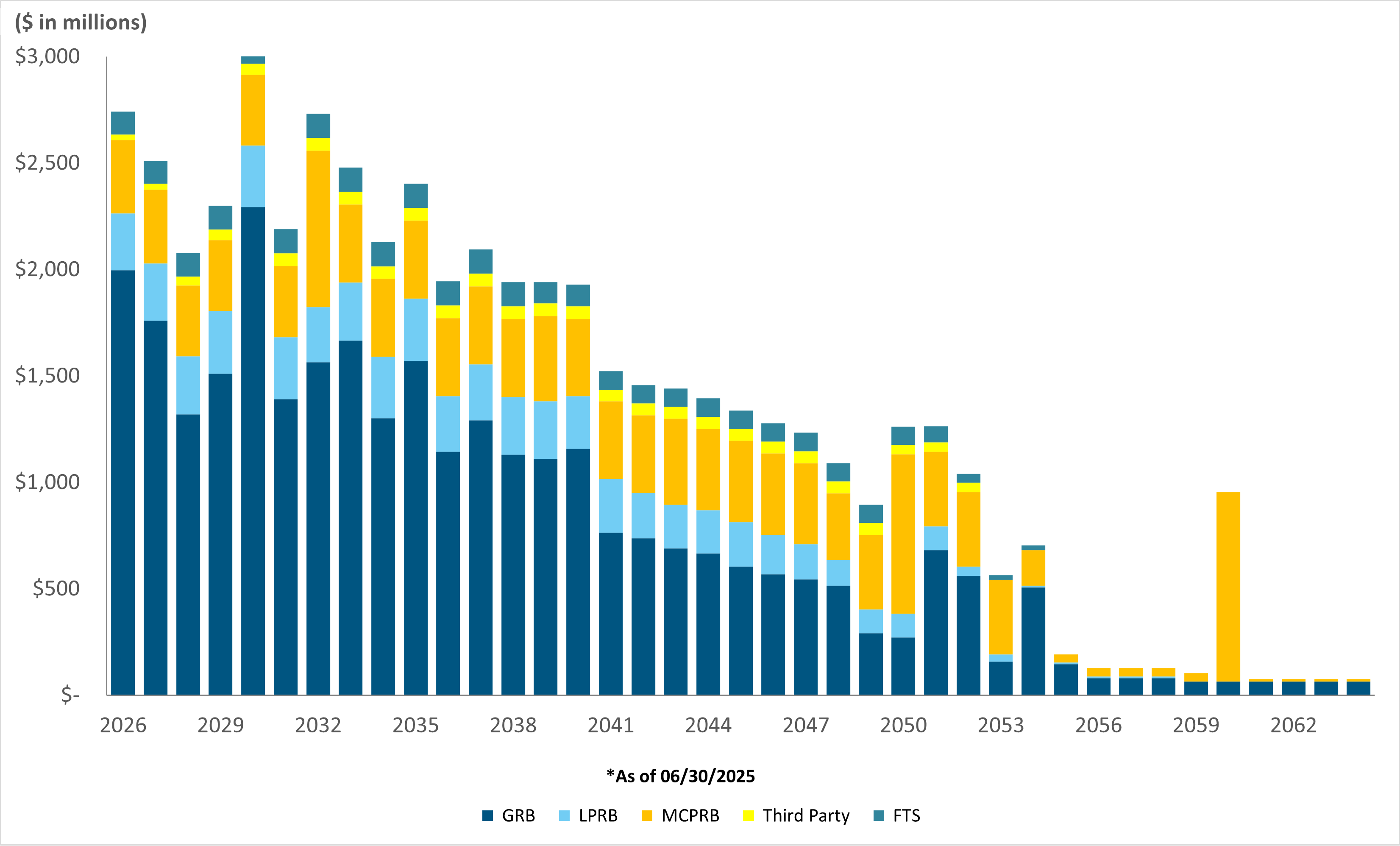

- Bonds Outstanding

- $30.02 billion

- University System

- 10 Campuses, 5 Medical Centers

The University of California is the public institution of higher education designated by the State of California in its Master Plan for Higher Education for the training of individuals for the professions, for the awarding of doctoral degrees in all fields of human knowledge, and for the conduct of research. Since it was chartered in 1868, the University has conferred approximately 2,777,000 higher education degrees, as of academic year 2020-21. The University’s administrative offices are located in Oakland, California.

The University is governed by a 26-member Board of Regents, 18 of whom are appointed by the Governor and approved by a majority vote of the State Senate (currently for a 12-year term), one student Regent, who is appointed by the board to a one-year term, and seven ex officio Regents who are members of the board by virtue of their elective or appointed positions. The ex officio Regents are the Governor of the State, Lieutenant Governor of the State, Speaker of the Assembly, State Superintendent of Public Instruction, President of the Alumni Associations of the University, Vice President of the Alumni Associations of the University, and the President of the University.

Classes began at Berkeley in 1873 and the University currently operates general campuses located in Berkeley, Davis, Irvine, Los Angeles, Merced, Riverside, San Diego, Santa Barbara and Santa Cruz; a health science campus located in San Francisco; and laboratories, research stations and institutes, affiliated schools, activity locations, and a statewide Division of Agriculture and Natural Resources. The University operates a cooperative extension program reaching into nearly every area of the State and numerous public service programs. The Education Abroad Program of the University is offered at many different host institutions around the world.

Image Gallery

News

Visit the Press Room to stay current on UC information and events.

Featured Projects

Finance Team

Nathan Brostrom

Meghan Gutekunst

Michael Linder

Hugo Liang

Suman Kumari

Ya De Htun

Victor Villagomez

Outstanding UC Debt

Talk to us

Have questions? Reach out to us directly.