Talk to us

Have questions? Reach out to us directly.

Overview

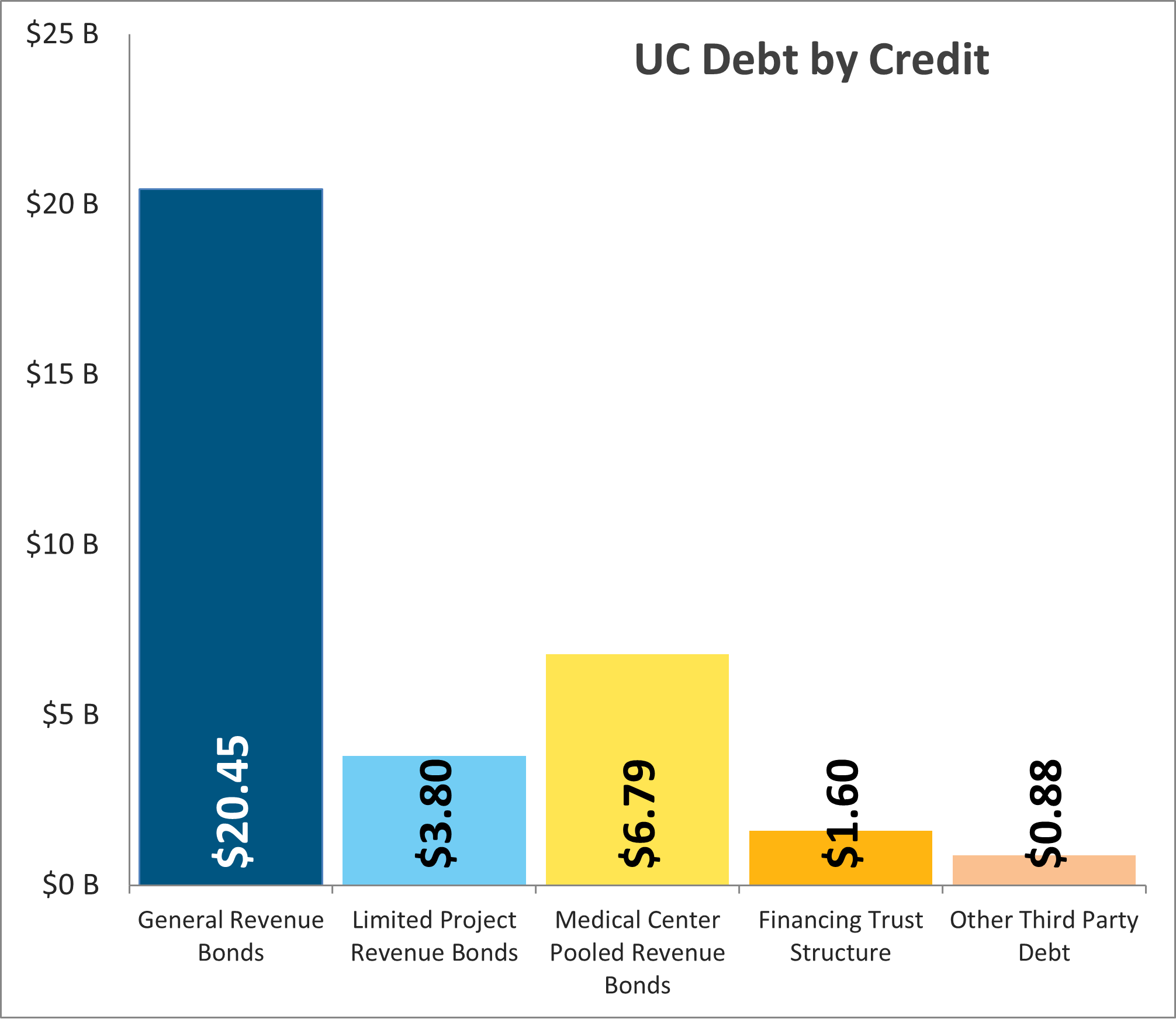

The University of California utilizes three primary borrowing vehicles: General Revenue Bonds, Limited Project Revenue Bonds and Medical Center Pooled Revenue Bonds and has a Commercial Paper Program. Please find below a general description of each borrowing credit. For outstanding amounts please refer to the charts and graphs included below.

General Revenue Bonds: The General Revenue Bond (GRB) credit serves as the University's primary borrowing vehicle and is utilized to finance projects that are integral to the University's core mission of education and research. The GRB credit is secured by the University's broadest revenue pledge. Pledged revenues for FY 23-24 were $21.7 billion. General Revenues, as defined in the GRB indenture, have been amended to include certain state appropriations to secure payment of the General Revenue Bonds.

Limited Project Revenue Bonds: The Limited Project Revenue Bond (LPRB) credit, established in 2004, is used to finance primarily auxiliary services such as student housing or parking. Pledged revenues for FY 23-24 were $1.9 billion. The LPRB credit provides the University's bondholders with a subordinated pledge of gross revenues derived only from facilities financed under the structure. This credit was created to conserve debt capacity in the GRB credit for mission-based projects.

Medical Center Pooled Revenue Bonds: The Medical Center Pooled Revenue Bond credit serves as the primary financing vehicle for hospital debt; its initial issuance occurred in January 2007. The Bonds are secured by gross revenues of the five medical centers. Pledged revenues for FY 23-24 were $22.2 billion. Previously, the medical centers issued debt on a standalone basis, secured by their individual revenue streams, of which no bonds remain outstanding.

Commercial Paper Program: The University's commercial paper program has an authorized amount of $4.0 billion. The program, which is a combination of both taxable and tax-exempt commercial paper, is used for a variety of purposes, including the funding of working capital and to provide interim funding for approved projects that are eventually to be funded using permanent financing.

Other University Debt: In addition to the primary borrowing vehicles listed above, the University also has other outstanding long-term debt obligations as listed below:

- Other Third Party Debt: Currently, the University has approximately $877.2 million* outstanding through the California Infrastructure and Economic Development Bank (CIEDB), which financed the costs of a Neurosciences Building at the San Francisco campus (issued in 2010), a research facility for the Sanford Consortium for Regenerative Medicine at the San Diego campus (issued in 2010), a Department of Psychiatry Youth and Family Center (2130 Third Street) at the San Francisco campus (issued in 2017), and the UCSF Clinical and Life Sciences Building at the San Francisco campus. For the bonds related to the Neurosciences Building and 2130 Third Street, the University is required to make base rent payments through a capital lease that equal the debt service on those bonds. For bonds related to the Sanford Consortium project, the University is required to make any debt service shortfall on those bonds through a debt service payment agreement. For the UCSF Clinical and Life Sciences Building, the University is also required to make base rent payments equal to the debt service on the bonds. In addition, the University has other third party, non-recourse debt for housing projects.

- Financing Trust Structure: The University has approximately $1.60 billion* of outstanding third-party housing debt (i.e. debt issued by a party other than the University but for a project in which the University has an economic interest) under its Financing Trust Structure (FTS) credit. Currently the projects in the FTS are housing projects at the Irvine, Riverside and Davis campus. The bonds are secured solely by gross revenues of the projects financed. Please see the University's Related Party Debt page for more information.

*Bonds outstanding as of June 30, 2025

Charts and Graphs

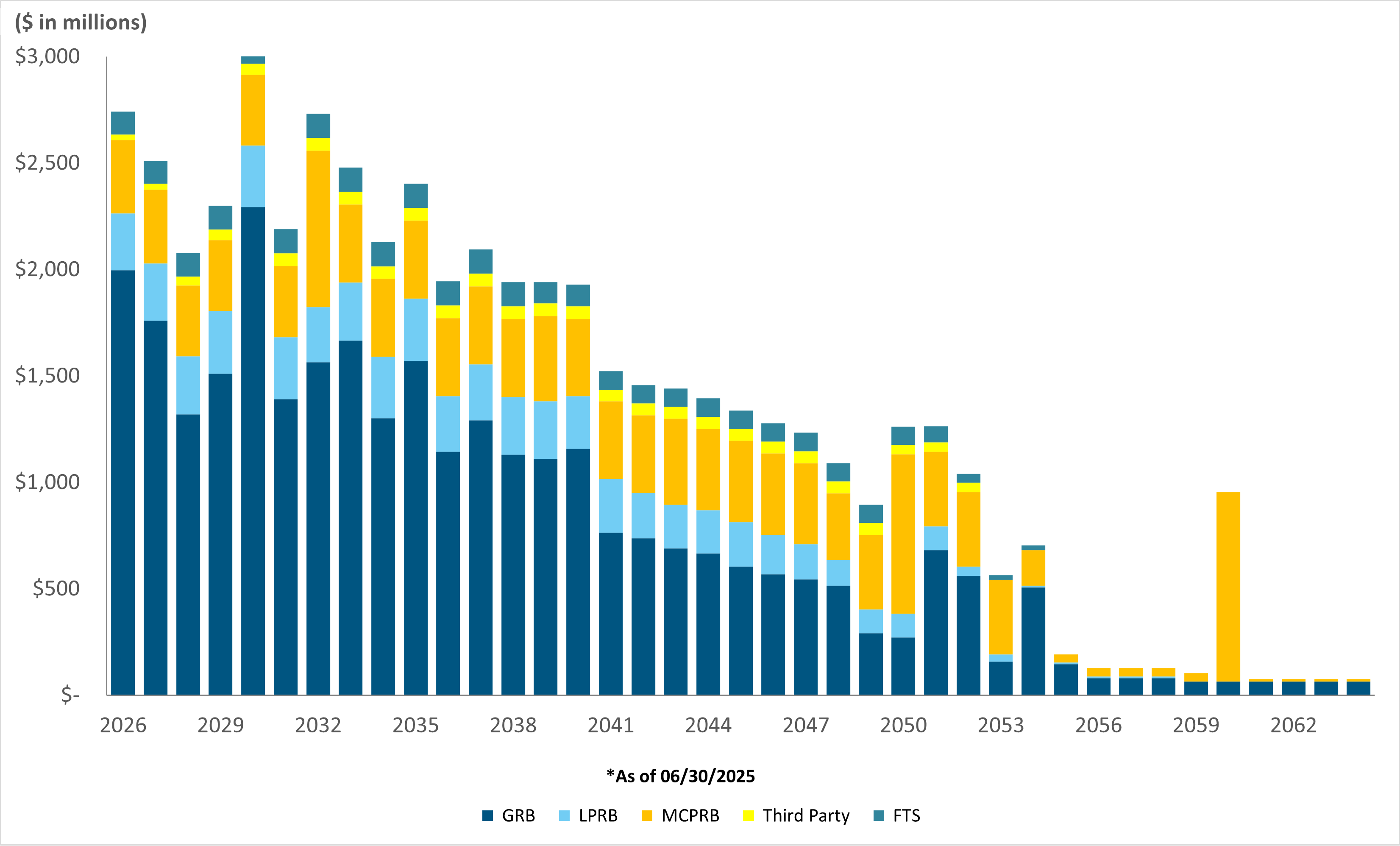

Notes:

- Data is as of 6/30/2025.

- GRB Series AL (variable rate) assumes interest at fixed payer swap rates until 2039 and 2.75% thereafter. GRB Series BP, MCPRB Series B, MCPRB Series O, and MCPRB Series K (all variable rate) assume interest at associated fixed payer swap rates. Series K assumes the hedged portion pays interest at the fixed payer swap rate and the unhedged portion pays interest at 2.75%. Series O assumes the hedged portion pays interest at the fixed payer swap rate and the unhedged portion pays interest at 2.75%. GRB Series BP and MCPRB Series B are fully hedged. GRB Series BY (variable rate) assumes interest at 2.75%.

- GRB variable rate Series Z (taxable) assumes principal is amortized FY 2038-2042. The series assumes an interest rate of 3.00%.

- UC 3rd Party Debt includes California Infrastructure and Economic Development Bank (Sanford Consortium Project) Series 2016A, California Infrastructure and Economic Development Bank (UCSF Neurosciences Building 19A) Series 2010A & 2010B (Taxable Build America Bonds), California Infrastucture and Economic Development Bank (UCSF 2130 Third Street) Series 2017A, and California Infrastucture and Economic Development Bank (UCSF Clinical and Life Sciences Building) Series 2025.

- FTS includes California Statewide Communities Development Authority Student Housing Revenue Bonds Series 2016, 2017, and 2021 (Irvine Student Housing), California Municipal Finance Authority Student Housing Revenue Bonds Series 2018 (Riverside Dundee-Glasgow Student Housing Project), Student Housing Revenue Bonds Series 2019 (UCR North District Phase I Student Housing Project), and Student Housing Revenue Bonds Series 2021 (Davis Orchard Park).

- Graph does not display debt service payments for bonds from 2064-2120.

- Debt service and statistics are net of Federal subsidies associated with Build America Bonds, Clean Renewable Energy Bonds, Recovery Zone Economic Development Bonds, and capitalized interest.

Talk to us

Have questions? Reach out to us directly.